Spot Exchange

Spot Exchange Software

Get a all-in-one, market ready digital asset exchange software, backed by capital market grade matching engine technology, with the banking core platform running at top performance from the day one.

Fastest

75Mn+ OPS

Access over to

375+ markets

- Cloud native

- Modular & Scalable

- Asset Agnostic

- Bank grade Security

- SaaS & Self Hosted

Trade on Digital Assets, Stocks, Commodities, Forex and many other asset classes.

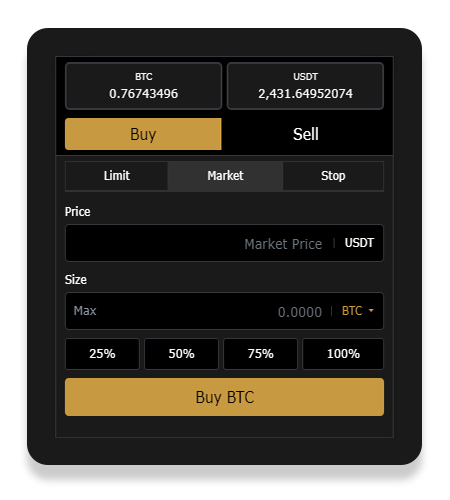

Buy, Sell and Trade

Easy Convert

Serve your retail customers just the way they would like, give them power of simplicity and speed. Easy Convert makes buying or selling easier, without the distraction of complex order books and OHLC charts.

- Straight-forward Conversion rates

- Spark-line Charts

- Top Movers

- Currency Switcher

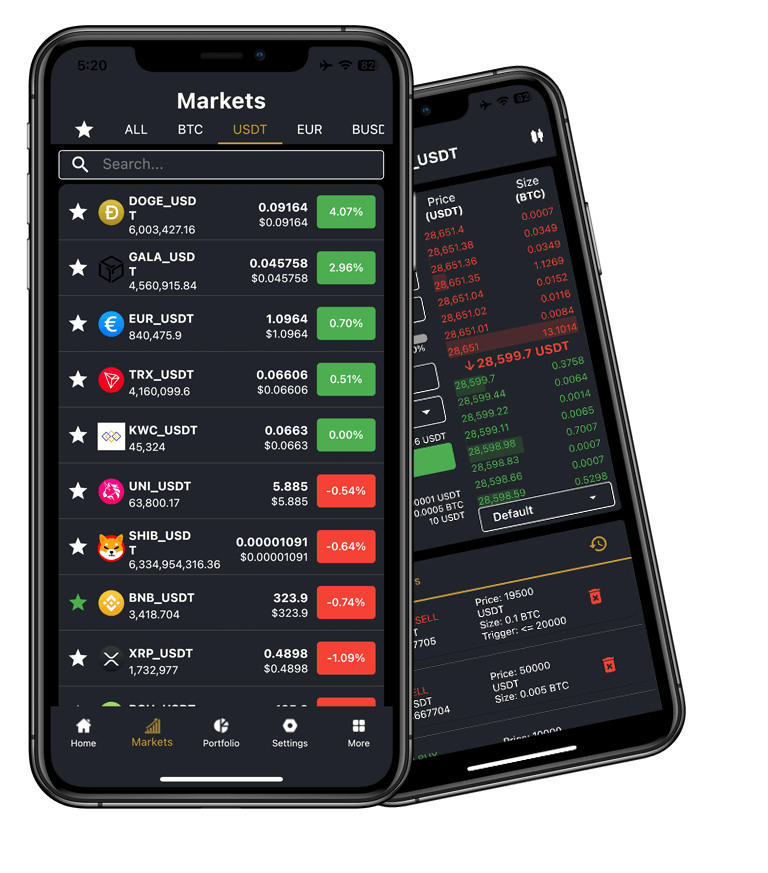

Pro Trading

Experience traders expect a more sophisticated trading platform. Our Pro trading interface offers a host of tools such as:

- OHLC with TradingView Charts

- Depth Charts

- Price-time priority Order Books

- Advanced Orders

- Stop Orders

- Day Orders

- Fill-Or-kill

- Immediate-or-Cancel

- Advanced Reports

Earn & Finance

Staking

Simplify the process of earning rewards for your customers, wherein, by “locking” some of their holdings into a staking pool for a certain timeframe, they’ll earn rewards.

- Consolidate stakes from your various customers.

- Generate yields (aka APY).

- Yield Markdown.

- Automatic Daily Payouts.

- Automatic Maturity.

Launchpad

Incubate innovative blockchain projects by helping them with fundraising, building community and a secondary market when they roll out their product or service. Getting access to early-stage deals means a bargain price for the investors before the public launch on the market, a win-win for your exchange customers. Of-course you will have a rigorous vetting process for listing projects.

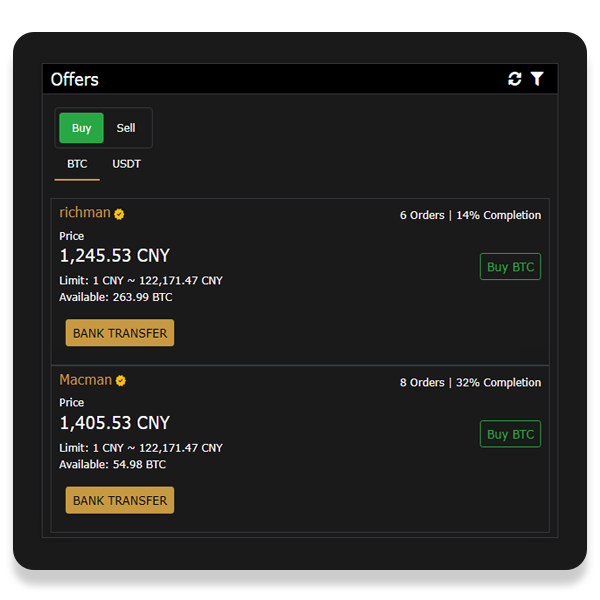

P2P Trading

P2P Trading

- Buyer & Seller can chat with each other directly.

- Detailed Stats for Buyer/Seller's past trades, e.g. Successful trades, Average release time.

- Multiple Payment methods.

- Parties can raise a dispute and appeal for refunds.

- P2P Merchants with Verfied Badge & Fee Discounts.

Wallets

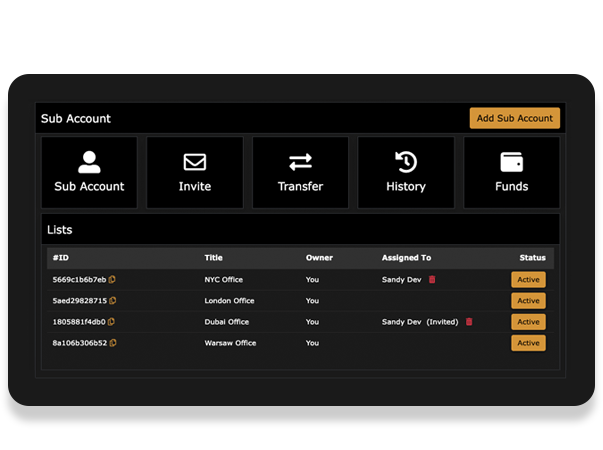

Sub Accounts

Sub Accounts allows segregate funds or operate multiple managed client accounts (if a fund of funds or asset manager).

- Assign or reassign your sub account to a Manager.

- Generate API keys per sub account.

- Instantaneous and free transfers between sub accounts.

- Freeze or UnFreeze sub accounts instantly.

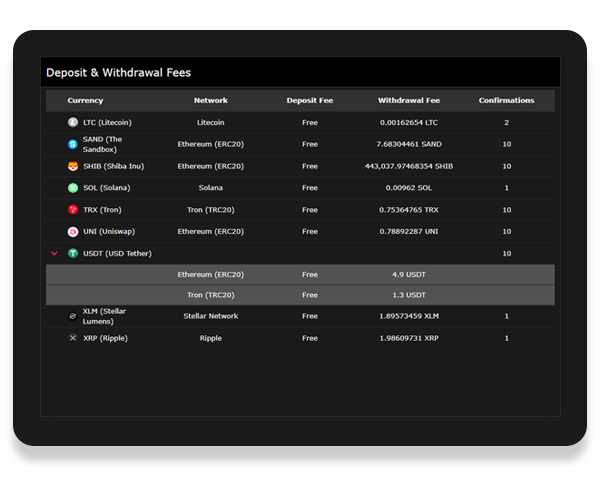

Dynamic Fee Models

Volatatilty is a big headache when it comes to exchange's fee for various services, such as withdrawals. When price appreciates, customers pay more and when depreciates, exchange looses more.

- Fee is defined in USD Notional.

- Dynamically updates, e.g. every minute.

- Zero loss to exchange because of sudden price fluctuations.

- Lowest fee for customers.

Features

Cloud Agnostic

Runs everywhere, any cloud, or even a bare metal. No more vendor lock-in, or hefty server rentals.

Microservices

All services interlinked with Pub/Sub channels to seamlessly share information with each other.

Fastest

100K OPS per instrument, which scales up to 100M OPS easily. Our system is fastest in the industry.

Business Continuity

Cold backup for mission critical systems and availability of stand-by servers in alternative data centers.

Upgradable

Fortnightly updates for common bugfixes, new features and third-party integrations.

Battle-Tested

We've processed over 10 million trades at the uptime mark of 99.5% availability, on a 100K active customer database.

Scalable

Our solution uses RAFT Clustering for scaling a service to support thousands of trading pairs. Fault Tolerance is built-in for high resiliency.

Most Secure

In-transit and At-rest encryption for data, OWASP ruleset compliance, Anti DDOS and DOS protection and more to protect your business from bad actors.

3rd Party Integrations

New features pipeline

We're tirelessly adding new features to our trading platform, to make it the most featured product in the market.

Choose what works best for your business

Starter Cloud

Our flagship subscription plan for startups who have low to moderate workloads.

Monthly Fee

- Spot, Staking, Launchpad & Convert.

- Upto 1K active users.

- Unlimited customers

- Unlimited transactions

- One availability zone

- Business continuity, Disaster recovery & Failover

Hybrid Cloud

Our handpicked cloud deployment for intense workloads. Do more, worry less.

Quarterly Fee

- Everything as in Starter Cloud

- Upto 10K active users

- P2P Trading & Sub-Accounts

- Fiat on/off ramps

- Multiple availability zones

- Mobile Apps (Android & iOS)

- Priority Support

Self Hosted

Enterprise solutions for ultra large exchanges who want total autonomy over the scale of operations.

One Time Fee

- Everything as in Hybrid Cloud

- Unlimited active users

- Private cloud deployment

- DevOps & SecOps qualified support

- Assistance for ISO & SOC2 compliance.

- High ROI & autonomy.

Platform FAQs

A white-label exchange is a software solution that allows businesses to launch their own digital asset exchange platform without having to develop the exchange technology from scratch. You can purchase software and rebrands it with your own name and logo. We typically provide ongoing technical support and maintenance for the platform, while you can focus on marketing, customer acquisition, and other business operations.

White-label exchanges can be customized to suit the needs of the business, including the features, design, and trading pairs available on the platform. This allows you to quickly launch a digital asset exchange under your own brand and without significant upfront costs, making it an attractive option for startups or established businesses looking to enter the digital asset space.

The platform includes a responsive web interface and mobile apps for iOS & Android devices.

We've integrated with Sum & Substance, Jumio & Onfido for individual KYC. For Business KYC, we use a manual system.

You control that, as you pay the KYC provider for their services directly. Our platform provides KYC integration using the provider's standard API documentation. You will be adding API credentials from your platform's back office.

Platform doesn't control the private key of the addresses issued to the traders. You hook your platform with popular asset custody services such as Fireblocks & Bitgo, wherein, you control & manage private keys using their service. Our platform enables the integration using their standard API integration, wherein, you add API credentials from your platform's back office.

Normally we offer up to 20 hours of UI/UX customization to match the color scheme of the platform with your branding guidelines. However, if your business requires extensive changes, we do offer consulting services at affordable hourly rates.

Business FAQs

If you're opting for a Cloud deployment then we will manage it entirely. If you are purchasing an on-premise deployment, your will be managing your infrastructure, of course, we will provide you with enough training before your go-live and support afterward.

Unlimited users, the number of concurrent user requests depend on the infrastructure size. For white labels who use our Cloud solutions (aka SaaS), their deployment is scalable and their traders receive a seamless experience as our backend is behind an auto-scaled load balancer that can scale up to hundreds of thousands of nodes.

Yes, we do accept customization assignments at all times; our delivery timelines purely depend on outstanding tasks we have in the development pipeline, as we serve on a first-come-first-serve basis.

Our platform is regularly pen tested and audited by external auditors. Should a client uncovers something that needs to be fixed, we promptly handle such reports.

Yes, we provide fortnightly updates to our cloud deployments and monthly updates for on-premise deployments. Updates are provided as binary builds along with the instructions and it is up to the client's DevOps team to upgrade their environment.

Yes, we do offer a 99.5% uptime guarantee for our Cloud brokers. To know more about it click here.